The Robot That Knows You Better Than You Do

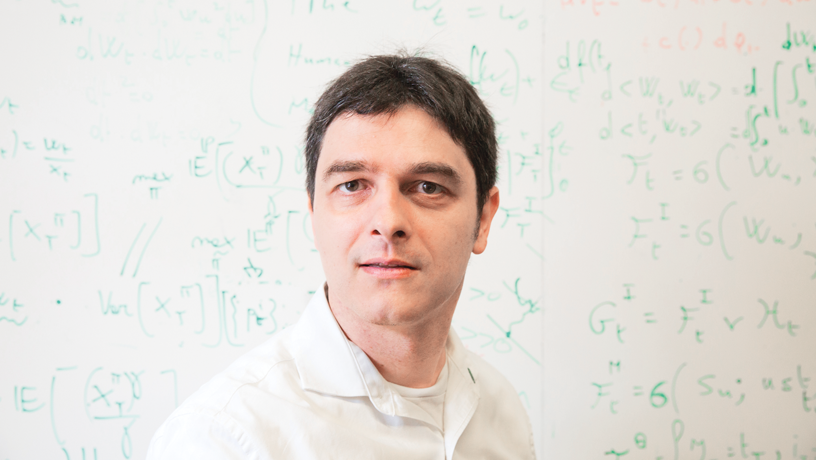

Agostino Capponi’s robo-advising model and its client learn from each other.

A clear example of innovative financialtechnology is robo-advising. Put simply, software replaces a human financial adviser to allocate various asset classes into a portfolio according to a client’s self described risk profile. But individualized robo-advising—the ultimate goal—doesn’t exist yet, said IEOR Professor Agostino Capponi, a member of the Institute for Data Science and Engineering. “Robo-advising currently is not self-adapting to the human it’s working with. The robot should be able to calibrate itself to you, as you both share the same objective, which is to maximize investment.”

The critical factor is the client’s tolerance or appetite for risk. Humans lack the ability to quantify that factor, so the system cannot know a priori its client’s risk preference—but, said Capponi, it should be able to learn it, and he is devising a machine learning tool he calls risk-sensitive Bayesian learning. He expects to complete the first step—designing the algorithms—by the end of 2017. Even though the human’s and machine’s objectives are aligned, asymmetric information—along with different sensitivities to risk for the human and machine— makes their joint optimization process essentially a game with strategic interactions. Capponi is thus developing a framework based on risk-sensitive dynamic games. “The human seeks to optimize her risk-sensitive criterion according to her true preferences, while the machine seeks to adaptively learn the human’s preferences and at the same time provide a good service to the human,” he explained. The research, funded by DARPA, could eventually be commercialized and the rights either licensed or sold to asset managers.

Capponi has a second major project in the fintech area: ascertaining the social welfare costs and benefits of a central bank digital currency (CBDC). A CBDC is electronically transacted and stored money, similar to a cryptocurrency such as Bitcoin, but guaranteed by a central bank. The main reason for a central bank to introduce a CBDC is to provide the public with an electronic means of cheaper payment systems.

“By developing a model for how people choose different payment methods,” Capponi said, “we aim at evaluating the conditions under which introducing a CBDC is socially beneficial.” The proposed model features an important trade-off: the efficiency improvements of a CBDC, relative to a traditional currency, lead to lower transaction costs; however, participating in the CBDC market requires the payment of entrance costs to set up the digital trading technology and results in loss of privacy, since transactions can be monitored by the state’s authority.

Capponi’s study, funded by the Global Risk Institute in Toronto, analyzes where a CBDC might be socially desirable, based on the structure and preferences of a country’s population. Several countries, like Japan, have already introduced a digital payment platform, but it is still an open debate whether other countries, including the United States, should take this step, Capponi said.