Absorbing Financial Shocks

Imagine a world where our global web of financial networks could anticipate and absorb shocks to the system and avoid financial crises

Capponi, whose research also spans optimization modeling and related areas, with a student.

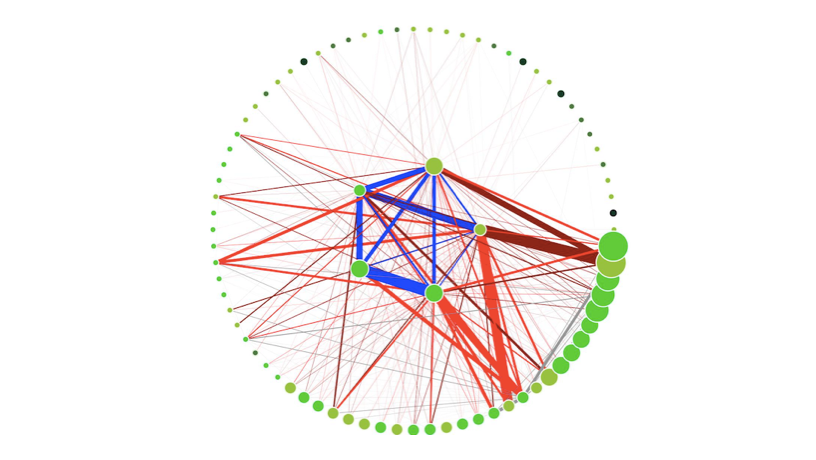

Core-periphery network of U.S. banks.

Diversification in the finance industry is a driving factor in globalization. It was also considered a smart strategy to maximize profits and protect against losses until the 2008 financial crisis challenged this belief. Our global, interconnected financial networks showed their vulnerability to contagion, uncovering an ongoing challenge for networks in how to prevent a disturbance in one part from cascading distress throughout the whole system.

Among the lessons learned: Society needs better policies to contain such crises.

Agostino Capponi, associate professor of industrial engineering and operations research, aims to improve the financial system’s ability to withstand network shocks by creating a deeper understanding of policies meant to mitigate financial contagion. By leveraging advanced techniques from network and game theory that help determine the most important players and connections in a network and identify their strategies, he develops frameworks to account for the many variables driving the economy and the dynamic relationship between banks and regulators. As a result, the U.S. Department of the Treasury, the Commodity Futures Trading Commission, and the Federal Reserve Board of Governors have sought Capponi’s expertise.

“Most existing research takes financial agents as mechanically responding to policies imposed by a regulator,” he says. “In contrast, my research endogenizes this mechanism. It accounts for banks’ incentives behind the adaptation to policies imposed by a regulator.”

In this framework, regulators would be able to anticipate the market’s response to measures imposed by the banks before they are put into place. This approach will enable regulators to create policies that align bank incentives with regulator interests.

Capponi, a member of the Data Science Institute and the Nie Center for Intelligent Asset Management, believes that a comprehensive framework for the system-wide evaluation of all risks and incentives is urgently needed—particularly concerning cybersecurity risks, as a growing number of transactions occur online.

“We need policy tools that will help create a safer and more transparent environment,” says Capponi, “where people’s daily jobs will not be severely affected by major economic shocks and where risks will be clearly identifiable and thus more easily mitigated.”