Xunyu Zhou

LIU FAMILY PROFESSOR OF FINANCIAL ENGINEERING; DIRECTOR OF THE FINANCIAL ENGINEERING PROGRAM, DEPARTMENT OF INDUSTRIAL ENGINEERING AND OPERATIONS RESEARCH

316 S.W. Mudd

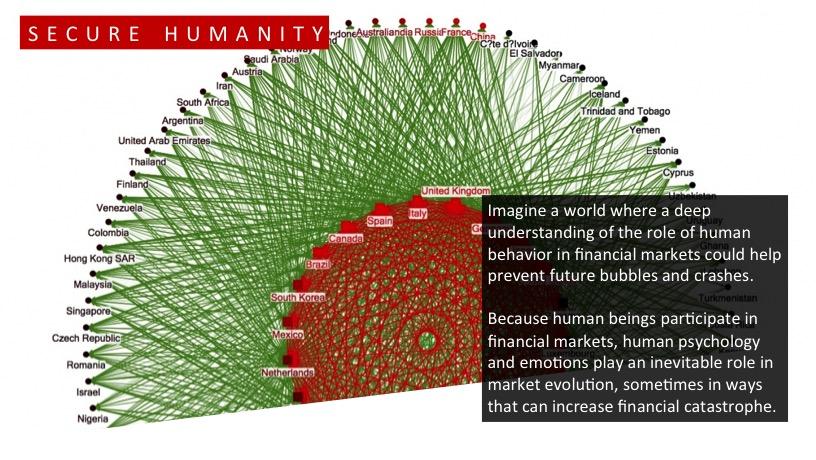

Xunyu Zhou is the Liu Family Professor of Financial Engineering at Columbia University in New York. His research focuses on quantitative behavioral finance models that incorporate human emptions and psychology into financial decision making, and on intelligent wealth management solutions using optimal control and machine learning techniques.

Research Interests

Behavioral portfolio selection and asset pricing, group preferences and decision makings, time-inconsistency and self-control, dynamic forward preferences, principal-agent problem, machine learning in asset management.Zhou is well known for his work in indefinite stochastic LQ control theory and application to dynamic mean-variance portfolio selection, in asset allocation and pricing under cumulative prospect theory, and in general time inconsistent problems. He directs the FDT Center for Intelligent Asset Management, a research center funded by a FinTech company. He has addressed the 2010 International Congress of Mathematicians, and has been awarded the Wolfson Research Award from The Royal Society (UK), the Outstanding Paper Prize from the Society for Industrial and Applied Mathematics, the Humboldt Distinguished Lecturer and the Alexander von Humboldt Research Fellowship. He is both an IEEE Fellow and a SIAM Fellow.

Zhou received his Ph.D. in Operations Research and Control Theory from Fudan University in China in 1989. He was the Nomura Professor of Mathematical Finance and the Director of Nomura Center for Mathematical Finance at University of Oxford during 2007-2016 before joining Columbia.

RESEARCH EXPERIENCE

- Postdoctoral fellow, Faculty of Management, University of Toronto, 1991-1993

- Postdoctoral fellow, Faculty of Sciences, Kobe University, 1989-1991

PROFESSIONAL EXPERIENCE

- Liu Family Professor of Financial Engineering, Columbia University, 2016–

- Nomura Professor of Mathematical Finance, The University of Oxford, 2007-2016

- Choh-Ming Li Professor of Financial Engineering, The Chinese University of Hong Kong, 2013-2014

- Assistant Professor/Associate Professor/Professor/Chair Professor of Systems Engineering and Engineering Management, The Chinese University of Hong Kong, Hong Kong, 1993-2007

PROFESSIONAL AFFILIATIONS

- IEEE

- SIAM

- INFORMS

- Bachelier Finance Society

- American Finance Association

GRANT SUPPORT

- FDT Center for Intelligent Asset Management, $2M

HONORS & AWARDS

- Archimedes Society Lecturer, Columbia University, 2017

- Fellow, SIAM, 2016

- Wolfson Research Award, The Royal Society, 2013

- Humboldt Distinguished Lecturer, Humboldt - Universitat zu Berlin, 2013

- Invited speaker, International Congress of Mathematicians, 2010

- Fellow, IEEE, 2005

- Croucher Senior Research Fellowship, Croucher Foundation, 2005

- SIAM Outstanding Paper Prize, SIAM, 2003

- Alexander von Humboldt Research Fellowship, AvH Foundation, 1993

- Monbusho Scholarship, Japanese Ministry of Education, 1989

SELECTED PUBLICATIONS

- J. Xia and X. Zhou, ``Arrow-Debreu equilibria for rank-dependent utilities", Mathematical Finance, Vol. 26 (2016), pp. 558-588.

- Z. Xu and X. Zhou, ``Optimal stopping under probability distortion", Annals of Applied Probability, Vol. 23 (2013), pp. 251-282.

- Y. Hu, H. Jin and X. Zhou, ``Time-inconsistent stochastic linear-quadratic control", SIAM Journal on Control and Optimization, Vol. 50 (2012), pp. 1548-1572.

- X. He and X. Zhou, ``Portfolio choice under cumulative prospect theory: An analytical treatment", Management Science, Vol. 57 (2011), pp. 315-331.

- Shiryaev, Z. Xu and X. Zhou, ``Thou shalt buy and hold", Quantitative Finance, Vol. 8 (2008), pp. 765-776.

- H. Jin and X. Zhou, ``Behavioral portfolio selection in continuous time'', Mathematical Finance, Vol. 18 (2008), pp. 385-426.

- D. Yao, S. Zhang and X. Zhou, ``Tracking a financial benchmark using a few assets'', Operations Research, Vol. 54 (2006), pp. 232-246.

- H. Jin, H. Markowitz and X. Zhou, ``A note on semivariance'', Mathematical Finance, Vol. 16 (2006), pp. 53-62.

- X. Zhou and D. Li, ``Continuous-time mean-variance portfolio selection: A stochastic LQ framework'', Applied Mathematics and Optimization, Vol. 42 (2000), pp. 19-33.

- S. Chen, X. Li and X. Zhou, ``Stochastic linear quadratic regulators with indefinite control weight costs'', SIAM Journal on Control and Optimization, Vol. 36 (1998), pp. 1685-1702.

Don’t do extensions; do something new.